Sep

Real estate investment trusts, or REITs for short, are investment vehicles used by businesses and individuals to invest in a diversified group of real estate assets. The investment vehicle is similar to more well-known investment options known as mutual funds. In simple terms, REITs are the mutual funds of real estate and can therefore give us a good sense of the trend in home prices and mortgages.

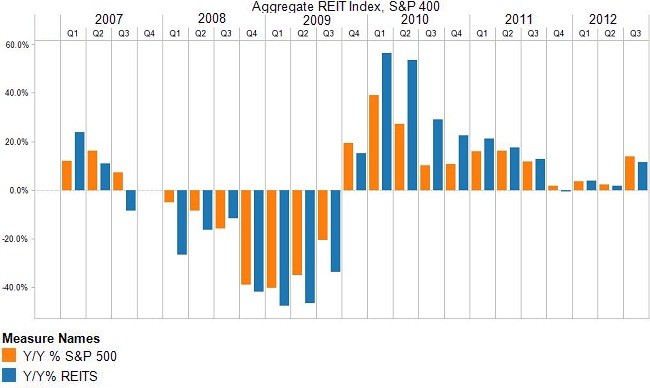

On the whole, REITs have provided market beating returns over the past three years –

- The index first moved into positive return territory in the fourth quarter of 2009, a good three years before the real estate market bottomed out (see chart above).

- The leading indicator nature of REITs provides reasonable confidence that the actual real estate market has bottomed out and is likely to continue to gain momentum

- The three year differential is a 39.7% return for REITs compared to the S&P 500 figure of 36.6%.

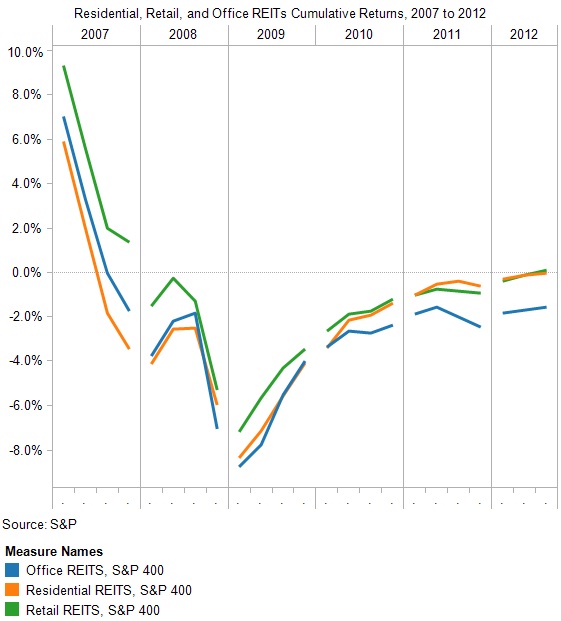

With the REIT group as a whole providing above market returns, what do the details look like? The three major groups of REITs are retail, residential, and office space. The returns of the three groups as a whole are shown in the following graph.

- On the whole, retail REITs, which represent investments in stores and other transactional business, is in the lead, with the index now 0.08% above where it was three years ago.

- Closely behind the retail REIT sector are residential real estate investments, with this index just 0.05% below where it stood three years ago.

- The laggard of the three is office space, with the index down 1.57% from where it stood three years ago.

- Overall, as leading indicators for the property holding sector, all three have experienced strong, leading returns since bottoming out in early 2009.

What again, does the leading nature of REITs indicate for the real estate market as a whole?

- Well, one thing stands out: REITs are about where they were at end-2007, which says a lot.

- All three REIT sectors are better than they were in Q1 2008

- Connecting this with, for instance, the residential real estate market, it would imply that the residential real estate market should provide decent returns and probably catch up with where it stood in 2007 over the next three to five years.

How decent of a return?

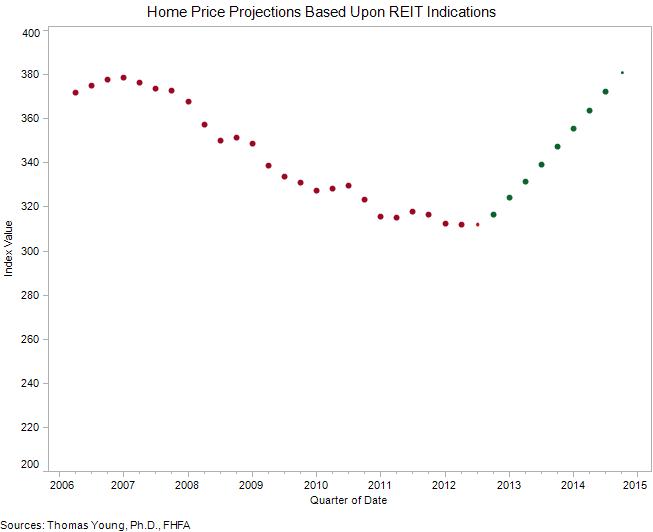

Well, ignoring other economic factors and including REITs as the only indicator for projected return, REITs would indicate average annual home price increases of about 13%. The REIT-based projection is shown in the chart below, where green is the home price forecast and red represents historical home prices. The forecast is possibly high, but the general direction indicated by the return of REITs over the past three years is right that home prices are on their way up.

In all, REITS are a leading indication of residential real estate values. With the returns of REITS over the past three years approaching 40%, this probably indicates that residential real estate value have bottomed out and are likely to increase over the coming years.

Facebook comments:

Powered by Facebook Comments