Jul

When applying for a home loan, one of the primary questions you must answer is whether to choose a 15-year, 20-year, or a 30-year fixed mortgage. All three options have their merits and flaws, and with interest rates at near historic lows, it is an excellent time to apply for or refinance to a 15 or 30-year mortgage, or even the less common but very sensible 20-year mortgage. Rates are great, but which is the best option? Not surprisingly, it depends on your personal goals and your financial situation.

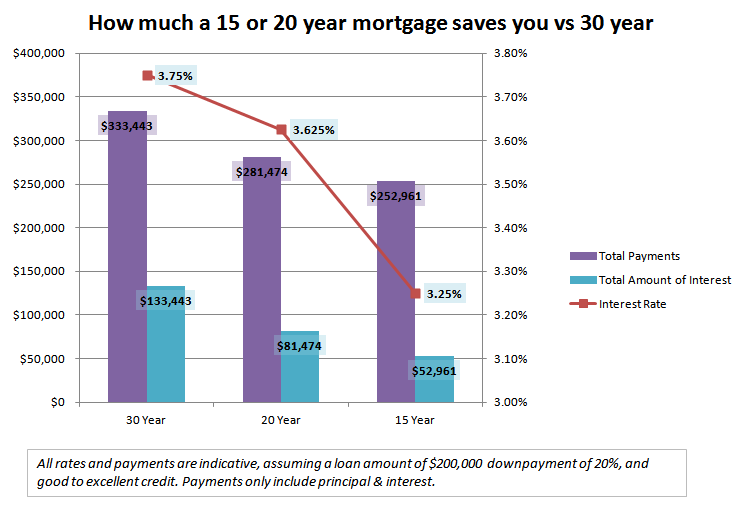

Let’s look at a simple chart comparing the costs of 15-year, 20-year, and 30-year loans.

Before we get to the numbers in the chart above, it is important to understand that numbers can be misleading. Before we discuss everything else on the chart, it is important to get one thing clear. If you cannot afford the monthly payment of the 15-year term, then you should not apply for such a short loan. Everything else is dependent upon your personal financial goals and lifestyle, but that is a hard and fast rule. If you can’t afford to make a payment, don’t take out a loan. That said, if a 15 year mortgage is only a little outside your comfort zone, you should definitely consider a 20 year term – you save much more than a 30 year and the increase in payment might be in your comfort zone.

Now, let us assume you can easily afford the payments for the 15-year and the 30-year length. On the surface, you have savings of over $80,000 when you take out a 15-year loan vs. a 30-year one, but hold on, you are making a payment that is $479 more than you would for the 30-year. If you invested that amount each month over the same time at 7-percent interest, you would have a comfortable nest egg of just over $408,000. That’s over 5 times as much as you would save over the life of your loan.

Of course, you have to take into account 2 things when discussing potential investments or savings. First, are you the type who can consistently put back $479 a month or will you spend it? Second, what if you paid off your home in 15 years and could invest the entire $926 for 15 years? Well, you would come out at just over $132,000 profit. That is significantly less than $408,000, but you would own your home. You would not be in any danger of losing your job and then the family home.

As you can see, the mortgage term you choose depends on your lifestyle and financial plan. If you are a person who can consistently save and not spend money, a 30-year term is likely the right choice. If you are a person who may or may not be able to save but hates being in debt to anyone, a 15-year term will allow you to pay off your home loan quickly, secure an asset, and move on to other things. The 20-year mortgage could give you the best of both.

Facebook comments:

Powered by Facebook Comments