Aug

Refinancing your mortgage is a lot like trading in a car – you’re looking for something better, but also don’t want to get ripped off. And, just as the economy affects the demand, supply, and prices of new and used cars, so it is with home refinances, with such things as financial institutions’ willingness to lend, market demand for interest bearing assets, home owner confidence in their expected income streams and desired spending patterns all affecting the strength of the market.With this brief background in mind, what does the market look like today?

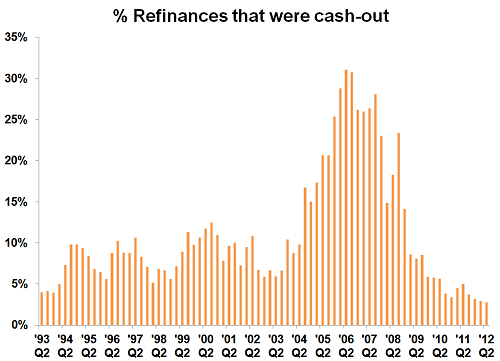

Let’s review a few of the indicators. The first measure is individuals taking cash out as a percentage of the total loans refinanced.

The measure peaked in the second quarter of 2006 at 31%. In contrast, the most recent number from Freddie Mac is 3% for the second quarter of 2012.

Does anyone see a bottom here? Certainly, the measure can’t go down much more, but there’s certainly room to go up. Do you think you could take the cash from your home equity and make money in the stock market or in other real estate investments? We originate loans in Texas and California and we sometimes wonder if there is anywhere for real estate prices to go but up? Of course, the reducing trend in this graph indicates a good deal of risk aversion on behalf of mortgage lenders and partially on behalf of borrowers.

Let’s look at three more market indicators –

- The percentage of refinancing resulting in a 5% or higher loan amount – most likely a cash-out, home equity mortgage. This would also include debt consolidation mortgages, i.e. where the homeowner took out equity in the existing loan to pay off other debts such as credit card debt, car loans, etc.

- The percentage resulting in no change to the loan amount or less than 5% such as due to closing costs

- The percentage resulting in a lower loan amount, which would mean homeowners actually brought money to the closing table in order to pay off their existing loan and closing costs of the new loan.

Here’s what the chart indicates –

- On the first – the percentage of refinancing resulting in a 5% or higher loan amount – the measure had generally floated between 35% and 90% for most of the survey’s history. Since the onset of the financial crisis and one of the worst economic recoveries on record, the percentage of loans where homeowners took more amount out than they came in with by at least 5% has dropped to about 19% in the second quarter of 2012, with the all-time low, according to Freddie Mac, being 15%, experienced in the fourth quarter of 2011. When will the real estate risk appetite return? An even better question – do we want it to? Isn’t it better this way?

- While the first indicator is slowly stabilizing in its trough, the percentage of refinances resulting in no change to the loan amount has increased to its all-time high, reaching about 59% in the second quarter of 2012. This is an indication that individuals want lower rates but are still generally cautious about how to manage their real estate assets. The cautiousness could be a long-term structural change, although the more likely outcome is that individuals’ risk appetites will return.

- The third possibility is instances when the homeowner refinances to get a lower mortgage amount, which increased to an all-time high of 47% in the fourth quarter of 2011. Remember, these are all situations where homeowners actually brought money to the closing table in order to pay off their existing loan and closing costs of the new loan.This is clear evidence that individuals are, again, being somewhere between extremely cautious and moderately cautious in the financial management of their real estate assets.

In all, the market is slowly showing signs of recovery. The question is how quickly a recovery could take place. And, that depends, at least partly, on the risk appetite of homeowners. However, the most important questions we can ask are, aren’t we better off with Americans being cautious about cashing out equity in their home? What happens to the landscape in a few years when people again start building equity? Will we go back to the days of home equity fuelled credit card binges?

Facebook comments:

Powered by Facebook Comments