You are here: Learning Center » Mortgage Market Acumen

21

Sep

Real estate investment trusts, or REITs for short, are investment vehicles used by businesses and individuals to invest in a diversified group of real estate assets. The investment vehicle is similar to more well-known investment options known as mutual funds. In simple terms, REITs are the mutual funds of real estate and can therefore give us a good sense of the trend in home prices and mortgages. (more…)

20

Sep

We all knows that banks have been giving out loans much slower in the last few years than they have before. But have we considered the domino effect of this slowdown, other than the obvious? (more…)

11

Sep

It is starting to look more and more like the housing market is bottoming in many areas. As part of our continuous tracking of the housing and mortgage market, we look at three important measures of the health of a given area’s real estate market (more…)

04

Sep

What factors affect the final mortgage rate at which willing buyers of homes and sellers of financing are able to agree? In certain ways, the setting of rates can be incredibly complex, with a plethora of factors able to influence rates, including expected inflation, default probability, government regulation, and maturity risk premium, to name just a few. (more…)

21

Aug

Price conscious customers are always looking for the best deal. How often and to what extent do households shift their mortgage type or structure because of a lower rate and/or some other reason? (more…)

14

Aug

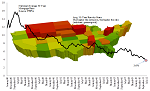

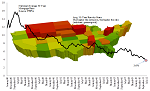

In the mid-2000s we saw what some might call the golden age of housing. In some places, such as coastline states like California or Florida, home prices appreciated as much as 30% in one year. In other areas of the nation, such as Texas and other natural resource rich states, home prices did not experience the steep run-up like California, but instead experienced steady home price appreciation with little home price depreciation when the housing market dropped. (more…)

10

Aug

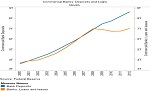

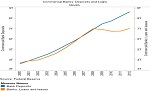

Refinancing your mortgage is a lot like trading in a car – you’re looking for something better, but also don’t want to get ripped off. And, just as the economy affects the demand, supply, and prices of new and used cars, so it is with home refinances, with such things as financial institutions’ willingness to lend, market demand for interest bearing assets, home owner confidence in their expected income streams and desired spending patterns all affecting the strength of the market. (more…)

01

Aug

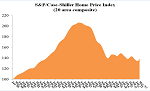

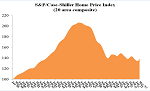

The S&P/Case-Shiller home price index figures came out this week. On the whole, the national home price index was up 2.2 percent over the prior month (seasonally adjusted basis) and increased 0.7 percent over the prior year. For the first time since the onset of the recession, home prices in all 20 covered statistical areas increased over the prior month. Additionally, on a year over year basis, 12 of the 20 areas are now above water. (more…)

24

Jul

Are fence-sitters losing out? Is it finally the right time to become a buyer in the housing market?

In the past week the market digested five housing market indicators – the National Association of Home Builders’ (NAHB) Housing Market Index, the MBA Mortgage Index, the Census Bureau’s Housing Starts and Building Permits, and the National Association of Realtors’ (NAR) Existing Home Sales. (more…)

17

Jul

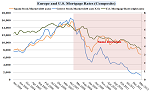

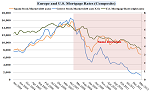

What do the retail sales numbers released this week and the recent European financial problems have to do with U.S. mortgage rates? Simple: both are putting downward pressure on U.S. rates. (more…)

17

Jul

In addition to the market forces affecting what people pay, the government, particularly the Fed (Federal Reserve), sometimes tries to influence what home buyers pay for their loans. What does this mean the current 30 year mortgage rate? (more…)