Sep

What factors affect the final mortgage rate at which willing buyers of homes and sellers of financing are able to agree? In certain ways, the setting of rates can be incredibly complex, with a plethora of factors able to influence rates, including expected inflation, default probability, government regulation, and maturity risk premium, to name just a few. In addition to these direct factors, high frequency economic and financial indicators affect the factors that influence interest rates, such as consumer confidence, the stock market, and international economic conditions. Although in practice numerous factors can impact an individual’s rate, there are really only four broad categories: inflation, default risk, liquidity risk, and maturity risk.

Inflation

Why would the rate at which prices are rising affect how much an individual has to pay on his or her home mortgage? Simple – a bank or mortgage provider is investing say $250,000 in an individual’s ability to give them the $250,000 back plus an additional $290,000 in interest over the course of a 30 year fixed rate mortgage @ 6%.

- If inflation is say 7% per annum on average, then, although the bank or mortgage provider is still getting $540,000 for the $250,000 loan, the real inflation adjusted value may only be $195,000, which represents a return to the mortgage provider of -22% over 30 years or an average yearly loss of around 0.7%.

- What does a mortgage provider’s return look like if inflation is 2% per annum? The provider earns about 60% over 30 years, or about 2% per annum.

What do investors expect inflation to look like over the next 30 years right now? Overall, the Federal Reserve Bank of Cleveland reports that individuals expect inflation rates of 1.86% per year over the next 30 years – close to an all-time low. The low anticipated inflation puts downward pressure on mortgage rates, a welcome sign for home buyers.

Default Risk

In addition to inflation risk, loan providers bear the possibility that an individual may not be able to pay back their loan. Whenever the probability of default rises, it puts upward pressure on home buyers. The probabilities of default figures are proprietary to a given financing business, but one indication of default probability is the rate of foreclosure. Overall, the percentage of home loans in the process of foreclosure as of the second quarter of 2012 is about 4.1%. Interestingly, the default probability over the past few years has been associated with lower mortgage rates, largely because the other factors have outweighed the effect of the default factor. With this said, the market appears to think that the probability of default for home mortgage loans has probably peaked, at least when measured in correlation with the recently observed mortgage rates.

Liquidity Risk

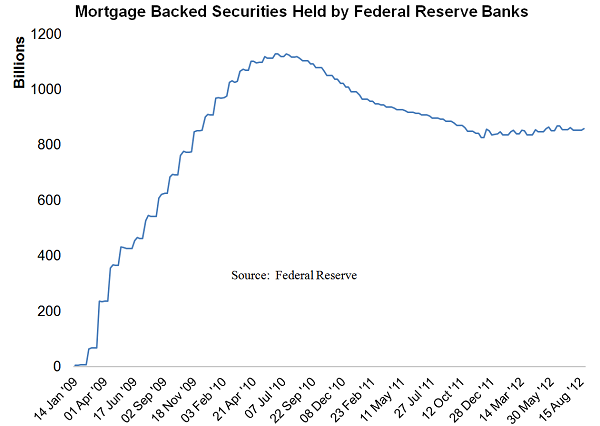

Whenever an individual is required to put in some effort to find a willing buyer for an asset, the probability of being unable to sell the asset increases – this probability, also known as liquidity risk, is present in most home mortgage loans. Because of the possibility that an investor won’t be found for a mortgage asset a bank would rather not hold, the interest rate offered to a home buyer increases somewhat (assuming all other factors equal). One somewhat recent innovation that has lowered the liquidity risk is mortgage backed securities, which are basically a way for banks to sell home mortgage loans to investors. By how much has the mortgage backed security market lowered mortgage rates? Well, that’s a question that requires considerable statistical analysis, but the development of the market has been correlated with at least a decline of 1% in the home mortgage rate seen by the buyer.

Maturity Risk

Mortgage buyers and sellers continually rethink the optimal term length of their mortgage asset or liability. And, for good reason, because the longer an individual intends to take to pay off a loan, the greater the length of time a financing company has its money tied up in the loan. Thus, providers of mortgage loans generally require a higher interest rate on longer term home mortgage loans to compensate for maturity risk.

Do Treasury Bill Rates affect Mortgage Rates?

Of the many factors that influence mortgage rates, one common misconception is that Treasury bill rates directly affect mortgage rates. That’s generally not true, although a bank or financing company may consider the Treasury bill rate in arriving at an offered mortgage rate.

On the whole, inflation, default risk, liquidity risk, and maturity risk affect an individual’s mortgage rate. At the moment, inflation is largely helping out the home buyer by being low, default risk is largely thought to have peaked, which is also helping out the mortgage buyer, liquidity risk continues to be partially minimized by the invention of mortgage backed securities, and maturity risk continues to be low.

Facebook comments:

Powered by Facebook Comments