Jul

What do the retail sales numbers released this week and the recent European financial problems have to do with U.S. mortgage rates? Simple: both are putting downward pressure on U.S. rates.

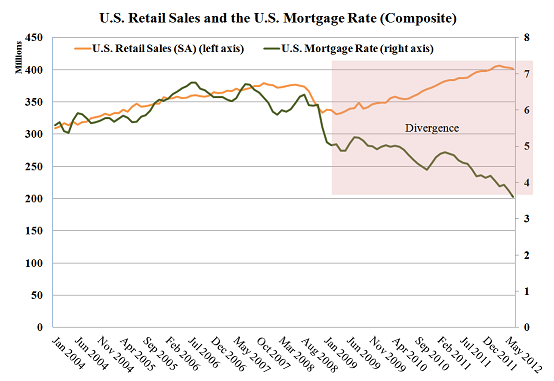

At 8:30 ET Jul 16, the Census Bureau released its estimate of June retail sales, coming in under analysts’ estimates at a decrease of -0.5 percent. At the same time, rates continued their downward trend to about 3.65 percent. Usually, there is a decent positive correlation between retail sales and mortgage rates, but over the past three years the two have diverged from each other.

What’s causing the divergence? Well, Federal Reserve actions to keep interest rates low are having an effect, as well as investors being very jittery about the health of the recovery, and lower than anticipated inflation. If you are a potential home buyer or are looking to refinance, you’ve got to ask yourself: how long can the divergence go on? At some point your fortunes are going to change.

What’s causing the divergence? Well, Federal Reserve actions to keep interest rates low are having an effect, as well as investors being very jittery about the health of the recovery, and lower than anticipated inflation. If you are a potential home buyer or are looking to refinance, you’ve got to ask yourself: how long can the divergence go on? At some point your fortunes are going to change.

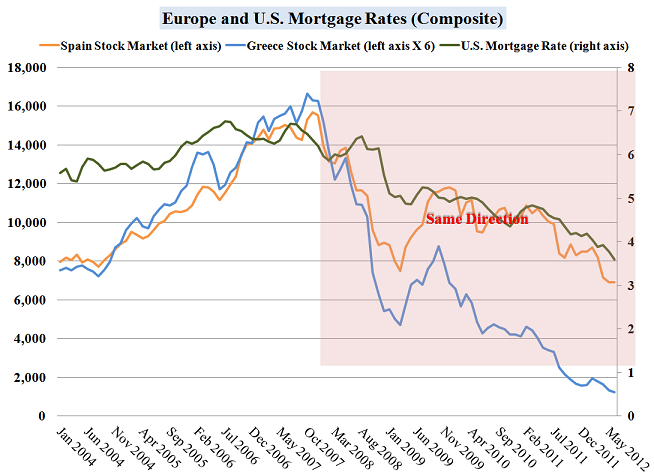

What about Europe, how could European financial problems possibly be affecting mortgages here in the U.S.? The answer is fairly straightforward. In times of concern over economic growth prospects, investors seek safety (often called a “flight to safety”), and investors generally consider U.S. treasuries as super safe. When demand for U.S. treasuries, which are linked to U.S. loan rates, goes up, yields go down (meaning the general rates go down). The correlation of the downturn in Spain’s and Greece’s equity markets in conjunction with the decline in U.S. rates is shown in the chart to the left.

For individuals that follow factors that influence mortgage rates, they often find it amazing that so many factors are working in favor of lower mortgage rates all at the same time. It’s not just a sales pitch from real estate professionals; it’s real and an almost for sure thing that we’ll never see rates like this in our lifetime. If you are considering buying a home or refinancing the one you already have, there’s a real good chance, in the current market, that it will be worth the risk.

Facebook comments:

Powered by Facebook Comments