Jul

In addition to the market forces affecting what people pay, the government, particularly the Fed (Federal Reserve), sometimes tries to influence what home buyers pay for their loans. What does this mean the current 30 year mortgage rate?

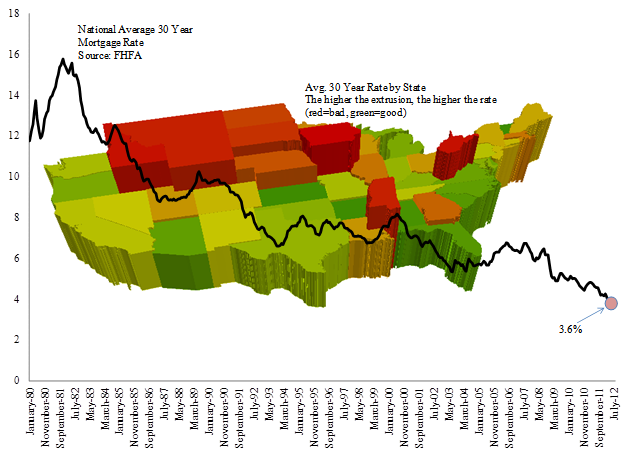

Over the past seven years, rates have decreased from a high of 6.8% in July 2006 to a low of 3.6% this past week. At any given time, a number of factors influence the rate buyers and sellers are willing to accept, such as:

- Income

- Employment

- Expected inflation

- Alternative uses of money

- Competition in the mortgage supply business

- Demand for mortgages

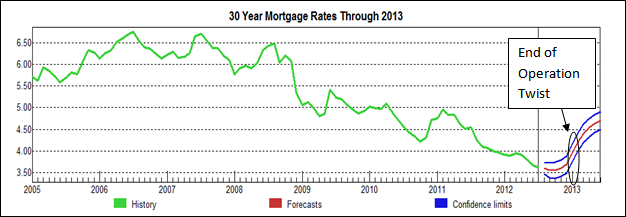

Whether you like government ‘meddling’ or not, since the onset of the recession in 2007, the Fed has taken a number of steps to lower certain interest rates, such as the fixed 30 year costs. One of the major steps the Fed has taken is “Operation Twist.” Operation Twist involves the buying of long term bonds while selling short term bonds simultaneously. Assuming all other things are equal, when they buy long term bonds it increases demand for these types of bonds, and by so doing puts downward pressure on long term interest rates, such as the 30 year mortgage.

When has the Fed been involved in buying long term bonds? They have been doing it for a long time, although the Federal Reserve’s interference has never taken on such a large scale. In September 2011, the Fed announced it would buy $400 billion of long term bonds and sell $400 billion of short term bonds. Operation Twist was set to expire at the end of June 2012. On June 20, 2012 Chairman Bernanke announced that the Federal Reserve would continue Operation Twist through the end of 2012 with an additional $267 billion in purchases.

What does this mean for my 30 year loan? Well, if you already have a 30 year fixed loan, except for the good feeling you get from knowing you got a better deal than your neighbors, it means nothing in terms of out of pocket expenses. On the other hand, for those considering refinancing or buying soon, it could be associated with around:

- $14,000 in savings over the life of your $200,000 mortgage (or about $40 per month);

- $21,000 in savings on your $300,000 mortgage (about $60 per month); and

- $36,000 in savings on your $500,000 mortgage (about $100 per month).

This all presumes you finance in 2013 before rates move into even higher territory. In some of the bigger states like California or Texas, where rates generally tend to be a little higher than the national average, it could mean a savings by as much as $22,000 over the life of your $300,000 mortgage (or about $61 per month).

In addition to the market forces affecting what people pay, the government, particularly the Fed (Federal Reserve), sometimes tries to influence what home buyers pay for their loans; that is the case right now. What does this mean for my 30 year mortgage rate?

Facebook comments:

Powered by Facebook Comments