You are here: Learning Center » Articles tagged as Mortgage

21

Sep

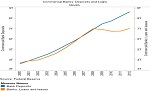

Real estate investment trusts, or REITs for short, are investment vehicles used by businesses and individuals to invest in a diversified group of real estate assets. The investment vehicle is similar to more well-known investment options known as mutual funds. In simple terms, REITs are the mutual funds of real estate and can therefore give us a good sense of the trend in home prices and mortgages. (more…)

20

Sep

We all knows that banks have been giving out loans much slower in the last few years than they have before. But have we considered the domino effect of this slowdown, other than the obvious? (more…)

11

Sep

It is starting to look more and more like the housing market is bottoming in many areas. As part of our continuous tracking of the housing and mortgage market, we look at three important measures of the health of a given area’s real estate market (more…)

04

Sep

What factors affect the final mortgage rate at which willing buyers of homes and sellers of financing are able to agree? In certain ways, the setting of rates can be incredibly complex, with a plethora of factors able to influence rates, including expected inflation, default probability, government regulation, and maturity risk premium, to name just a few. (more…)

21

Aug

Price conscious customers are always looking for the best deal. How often and to what extent do households shift their mortgage type or structure because of a lower rate and/or some other reason? (more…)

20

Aug

How much are you paying for the peace of mind of owning a free and clear home?

We are taught from an early age that debt is bad, and in most cases, carrying significant debt is not a good idea. If you are carrying a large balance on your credit cards, you should pay that off as soon as you can. If you have other secured or unsecured debt, you should pay that off as well. But when it comes to your mortgage, opinions differ regarding whether you should pay your mortgage off early or use the money for other purposes. (more…)

14

Aug

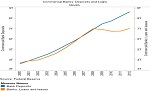

In the mid-2000s we saw what some might call the golden age of housing. In some places, such as coastline states like California or Florida, home prices appreciated as much as 30% in one year. In other areas of the nation, such as Texas and other natural resource rich states, home prices did not experience the steep run-up like California, but instead experienced steady home price appreciation with little home price depreciation when the housing market dropped. (more…)

17

Jul

What do the retail sales numbers released this week and the recent European financial problems have to do with U.S. mortgage rates? Simple: both are putting downward pressure on U.S. rates. (more…)

17

Jul

In addition to the market forces affecting what people pay, the government, particularly the Fed (Federal Reserve), sometimes tries to influence what home buyers pay for their loans. What does this mean the current 30 year mortgage rate? (more…)